Transfer pricing assessment

Do I have transfer pricing documentation requirements?

Transfer pricing is important for companies that are part of a multinational group and conduct transactions within the group. Therefore, we need information on whether or not you conduct business through foreign entities and/or permanent establishments, and what (kind of) intercompany transactions take place within the group.

The transfer pricing documentation requirements depend on the consolidated revenue of the multinational group and the countries in which you are located. Therefore, we also need to know whether you exceed, for example, the EUR 50 million or even EUR 750 million consolidated revenue (as the level of detail of transfer pricing documentation requirements increase when the group's revenues rise above the aforementioned thresholds) .

To get the full picture of your company, we also need more specific information. For example, whether you also conduct intercompany transactions with entities/permanent establishments in low tax jurisdictions. But also whether there have been any transfers of intangible assets within the group (e.g. transfer of a client portfolio).

With a completed questionnaire, our experts are able to analyse the collected information and will provide you with high-level advice on the possible transfer pricing risks and possibilities to strengthen your transfer pricing policy.

General

- Does the group include foreign entities and/or permanent establishments/branches?

- Do intercompany transactions take place within the group? If yes, please further specify the type of intercompany transactions.

- Provision of services

- Delivery of goods

- Usuage and/or joint development of intangible assets

- Financial transactions

- Have intercompany agreements been concluded for the intercompany transactions?

- Are transfer pricing policies (i.e. overview how to remunerate a transaction, such as cost plus x%) set-up for these intercompany transactions?

- Are benchmark studies performed to substantiate the remuneration for the intercompany transactions?

- Do these benchmark study(ies) contain data for the year 2016 and/or later years?

Transfer pricing documentation

- Has the group a consolidated revenue exceeding EUR 750 million?

- Has the group a consolidated revenue exceeding EUR 50 million?

- Is a country-by-country report prepared?

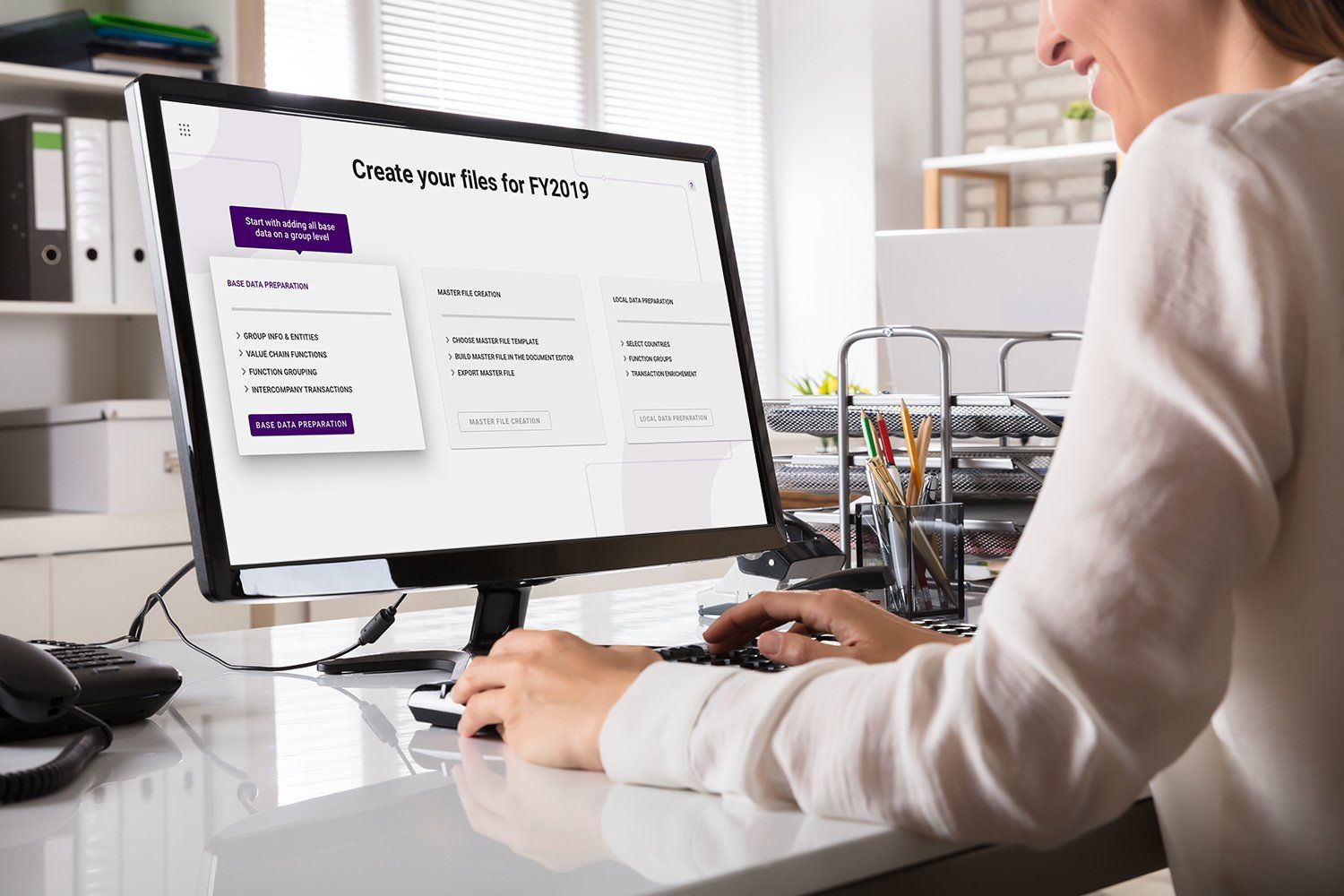

- Is a master file prepared?

- Are local files prepared for the entities and/or permanent establishment/branches engaged in intercompany transactions?

Specific questions

- Do intercompany transactions occur with entities and/or permanent establishments/branches located in low tax jurisdictions (tax havens)?

- Do intercompany transactions occur that constantly result in losses on one or both sides of the transaction?

- Have business restructurings taken place within the group (e.g. shift of the location of production)?

- Has there been any transfer of intangible assets within the group (e.g. transfer of a client portfolio)?

If you would like to discuss how we can be of service to you, please make an appointment for a free consultation by phone or (teams) meeting. We are looking forward to meet you.