Transfer pricing documentation

Adequate and robust transfer pricing documentation has become increasingly important in order to meet local annual compliance obligations. Transfer pricing documentation involves describing and substantiating the arm’s length nature of the applied transfer pricing policies.

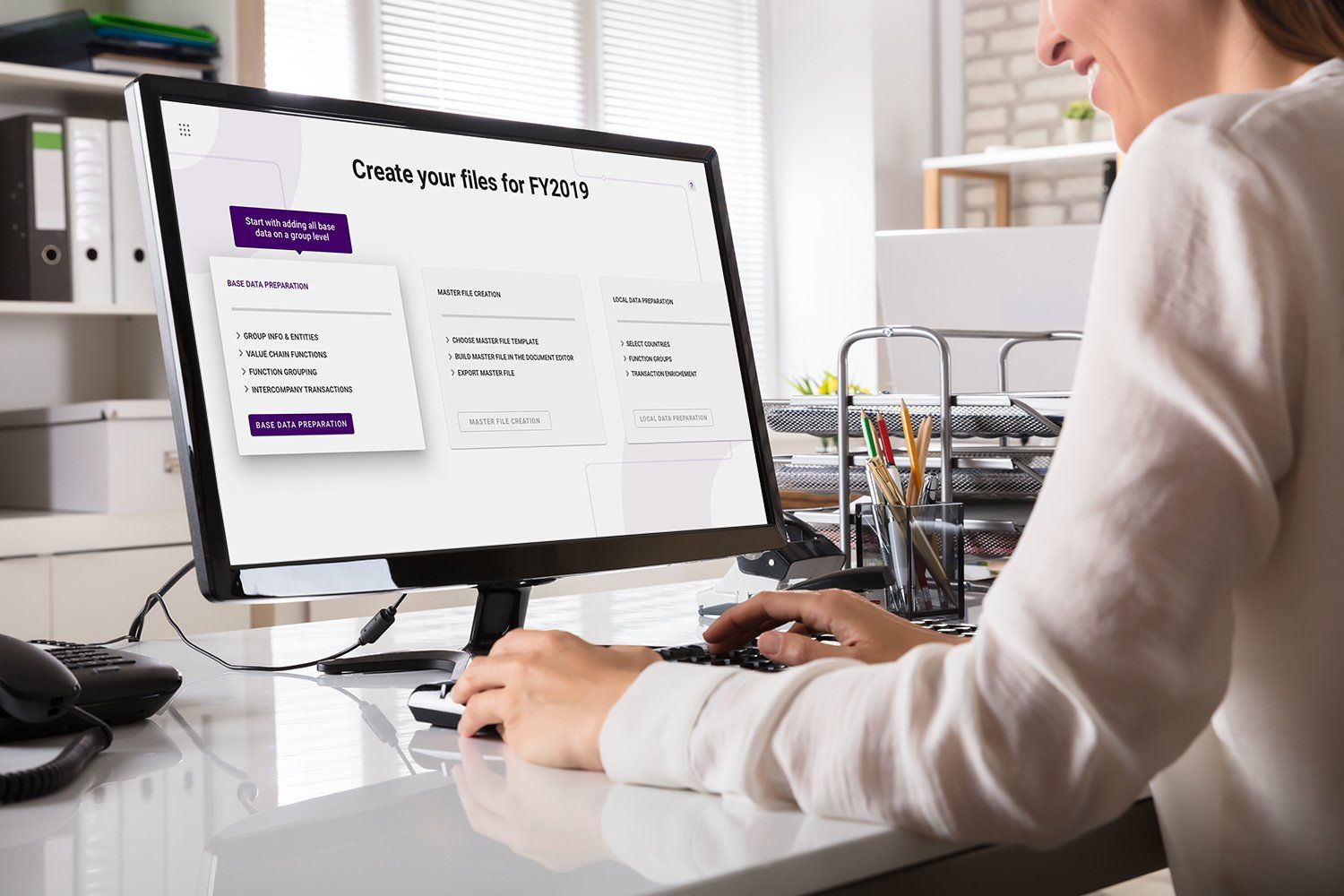

Since the introduction of the Master File, Local File and Country-by-Country reporting, the compliance requirements of multinational groups have increased considerably. Multinational groups are faced with questions such as:

- How to set up this documentation as efficiently as possible?

- How to keep the documentation up-to-date and consistent across the group?

- How to ensure it is prepared and filed on time.

In addition, benchmarking analyses to set and/or substantiate intercompany prices must be regularly updated.

Transfer pricing documentation solutions

JR Management & Advies is able to provide a variety of solutions. These solutions are fully adapted to your business needs. Our transfer pricing compliance services range from:

- Identifying potential risks and shortcomings during a documentation review engagement

- Arrange for benchmarking analyses

- Complete documentation management where we relieve the in-house tax team

- Assist with the group’s worldwide documentation requirements in a consistent manner.

We will assess which part of the compliance process you would like to take care of yourself, and which part can be dealt with by our transfer pricing specialists. This integrated approach ensures compliant transfer pricing documentation. The documentation combines your business know-how and market intelligence with our transfer pricing expertise and experience.

The Netherlands

In the Netherlands, the transfer pricing documentation required depends on the group’s consolidated revenue. That revenue will determine whether the following statutory requirements must be complied with:

- Preparing general transfer pricing documentation

- Preparing documentation in the Master File and Local File format and/or preparing and submitting a Country-by-Country report and/or notification

Interested in our services? We’re here to help!

We want to know your needs exactly so that we can provide the perfect solution. Let us know what you want and we’ll do our best to help.